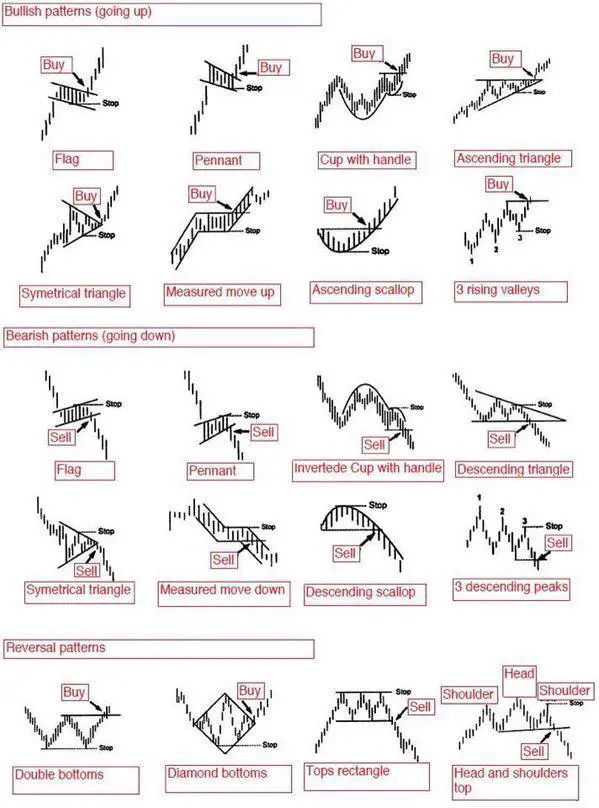

Chart patterns are visual representations of the behaviors of buyers and sellers around different price levels. Chart patterns are bullish when a chart is making higher highs and higher lows, they are bearish when they are making lower highs and lower lows, and range bound when they have defined support and resistance levels and no trend.

Trading chart patterns is primarily momentum trading where a breakout of an existing pattern is the signal to enter a trade. Technical traders use the breakout of an existing trendline in a pattern to establish an entry point. After they are in, then a trade is managed to maximize a gain or minimize a loss to create a good risk/reward ratio. Chart patterns can signal breakouts, reversals, and continuations of current price action.

Trading chart patterns step by step:

- Identify a pattern on a chart based on the parameters of price action. (The chart pattern cheat sheet below can be used as a guide).

- In a bullish chart pattern a buy signal is triggered on a break and follow through above a trendline of resistance of the existing price range consolidation after an upswing in price action. In a bearish chart pattern a sell short signal is triggered on a break and follow through below a trendline of support of the existing price range consolidation after a down swing in price action.

- After a trade entry a price target can be established based on previous resistance on a long term chart or overbought readings for a bullish chart or previous support on a long term chart or oversold readings for a bearish chart.

- A stop loss can be set at a reversal back through previous range support for a bullish pattern or a break back over previous range resistance for a bearish pattern.

- Position size should be conservative and not risk a big loss if the chart pattern does not follow through with a trend. 10% of total trading capital is a good general position sizing parameter for most stock trades, less if a chart is volatile, more if an index ETF is being traded. For options and futures trading it is smart to never risk more in position sizing than you are willing to lose capping risk at 1% to 2% of total trading capital on a position that can quickly go to zero.

- Chart patterns can increase the odds of success by going with the trend and flow of current price action.

Chart patterns are not predictive tools they simply show the odds of the direction a chart is likely to go. When the momentum plays out after a breakout then the magnitude of the profits can be many times greater than the loss that is minimized by a stop loss. Chart patterns are ways to create great risk/reward ratios through reactive technical analysis, they are not crystal balls. Profitability comes from big wins and small losses not accuracy with a high win rate.

Comments

Post a Comment